What is the Break Even Point?

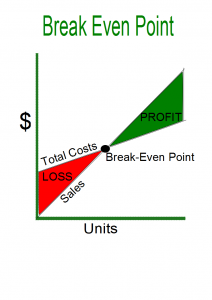

The break even point (BEP) is the point when your revenues are equal to your costs. When this point is reached, there are no gains or losses, you break even. Keep in mind, this point is reached during the normal course of business – your company has sold some products/services and your business has incurred some expenses.

Revenues = Total Costs => Break Even Point

Why is the Break Even Point Important?

I know what you’re thinking – boring, boring, boring. Stay with me, I’m getting to the fun part. Your break even point is the magical number of units you need to sell in order to start making a profit. When your business is profitable, that means more money in your pocket!

Let’s say your business sells bicycles. You figure out your break even point is 250 bicycles. If you sell less than 250 bikes in the month, your business will operate in the red and you will loose money. This is because you did not sell enough bikes to cover your costs. However, if you sell more than 250 bikes in the month, your business will make a profit. Meaning you have sold enough bikes to cover your costs and have extra money left over! If you sell exactly 250 bikes, you will break even – you will not have a loss or a profit. You will exactly cover your costs for the month.

How is the Break Even Point Calculated?

Whether or not you’re good with numbers or like numbers, it is important to learn how to calculate your break even point. Don’t worry, I’ll try to take it easy on you.

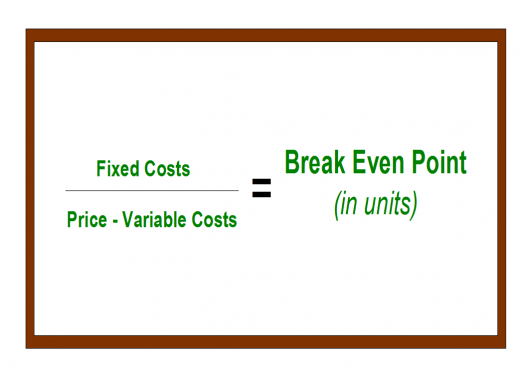

From the formula above, you can see that you need to know 3 things in order to figure out your break even point (in terms of units).

1. Fixed Costs – costs that don’t change based on your level of sales (overhead costs – rent, phone, internet, owner compensation, depreciation of assets, property taxes, etc).

2. Variable Costs – costs that change based on your level of sales (cost of goods sold (COGS) – sales commissions, wholesale cost of the product, costs to produce your product, factory labor, etc).

3. Price – price you sell your product for. This is typically figured out by looking at the wholesale cost plus your markup, or the cost of manufacturing your product plus your markup.

Now the fun part! Let’s play with the numbers and see how this works!

Bicycle Shop has figured out the following amounts:

Fixed Costs = $10,000

Variable Costs = $110/bike

Price = $150/bike

So…

Fixed Costs / (Price – Variable Costs) = Break Even Point (in units)

$10,000 / ($150 – $110) = Break Even Point

$10,000 / $40 = Break Even Point

Break Even Point = 250 Bikes

The bicycle shop needs to sell 250 bikes each month to break even. This will cover their costs, but the bicycle shop will not make a profit.

Fun Fact – the denominator of the equation (Price – Variable Costs) is called the Contribution Margin. The Contribution Margin is the portion of each sale that contributes to Fixed Costs.

How Does This Apply to My Business?

What if your sales change? The economy goes into a recession, new competition enters the market place, the demand for your product changes, etc. All these changes can cause your sales to drop. If this happens, you won’t be able to sell enough of your product to cover your costs. When you don’t cover your costs, your business operates at a loss.

What if your costs change? Maybe you move to a different office or store front, and as a result you face an increase in rent. Maybe your supplier or wholesaler raises their prices. Maybe business is getting busier, so you decide to hire more employees. All of these changes to your business will increase your costs. A change in costs will affect your break even point. Can your business sell enough of your product or service to cover these new costs and generate a profit?

Let’s look at the bicycle shop example above and take it a step further. We figured out the bicycle shop needs to sell 250 bikes to break even. The problem is, the bike shop owners don’t think they can sell 250 bikes in a month. Now the business owner knows they need to make some changes to avoid loosing money. What changes can the bicycle shop owners make in order to break even?

1. Price –

Increase the sales price for the bikes. If they are able to increase the price of their bikes, they can get away with selling fewer bikes to cover their costs.

What if they raise their prices to $175/bike. Their new break even point would be:

$10,000 / ($175 – $110) = Break Even Point

$10,000 / $65 = Break Even Point

Break Even Point = 154 Bikes

Now, the bicycle shop would need to sell 154 bikes each month to break even. Problem is, raising prices is not always an option.

2. Fixed Costs –

By reducing their fixed costs, the bicycle shop will have a lower break even point.

What if the bike shop owners negotiate a $1,000 discount on their monthly rent. Their new break even point would be:

$10,000 – $1,000 / ($150 – $110) = Break Even Point

$9,000 / $40 = Break Even Point

Break Even Point = 225 Bikes

Now, the bicycle shop would need to sell 225 bikes each month to break even.

3. Variable Costs –

Reducing their variable costs is another way the bike shop owners can lower their break even point.

What if they found a new supplier that sells wholesale bikes for $10 less than their original supplier. Their new break even point would be:

$10,000 / ($150 – $110 – 10) = Break Even Point

$10,000 / $150 – $100 = Break Even Point

$10,000 / $50 = Break Even Point

Break Even Point = 200 Bikes

Now, the bicycle shop only needs to sell 200 bikes each month to break even.

As a small business owner, you can see that any decision you make about pricing your product/service, the costs your business incurs, and the resulting volume that you sell are all interrelated. Knowing how many units you need to sell in order to break even allows you to set up meaningful sales goals. Sometimes making the transition from the red to the green is as simple as changing your price or costs. By performing a break even analysis, you can effectively and smartly make changes to your business to help you cover your costs. When you operate a profitable business, the result is more money in your pocket! Cool stuff and very important in running a successful business!